The Marston's Opportunity

- Suburban dominated locations

- Flexible estate to evolve at pace

- Pubs with scope for multi-occasions

- Expertise in running local pubs

Marston’s is growing and evolving, powered by a clear purpose: Shared Good Times. It’s what unites our people, creates lasting memories for our customers, and delivers real value for our shareholders.

This is underpinned by a strong investment case, with powerful value drivers for growth, key points of differentiation to ensure Marston’s wins in a growing market, and clear and consistent metrics to track our success.

With strong momentum and a proven approach, we’re investing and innovating to help our pubs, our people and our business thrive.

Download our Investor Factsheet

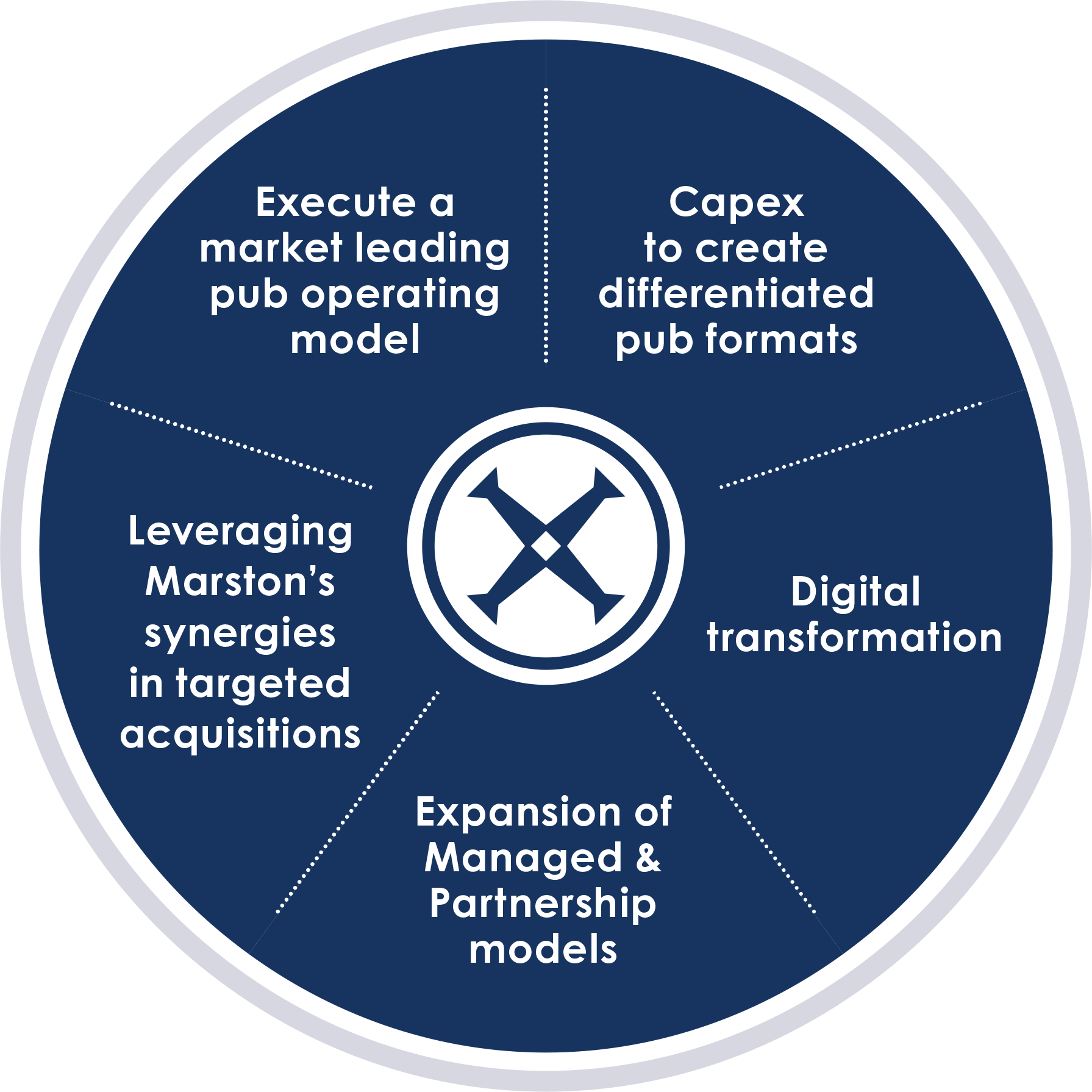

Our investment case is based on our five key value drivers:

Contributing to the transfer of value to shareholders as a result of growth in enterprise value, plus paying down debt

Near to medium-term targets:

Revenue growth ahead of the market

Sustained EBITDA margin expansion

200 - 300 bps

Incremental returns on investment Capex

Of recurring free cash flow generation

Financial Highlights FY2025

£897.9m

+1.6% LFL growth

£205.1m

Up 7%

22.8%

Up 140bps

£72.1m

Up 71%

£53.2m

Up 22%

4.6x

Reduced from 5.2x

Fancy another?